Seriously! 43+ List About Drag-Along Rights They Forgot to Share You.

Drag-Along Rights | You can read more about drag along rights here. For more detailed info checkout these. Specifically, it requires a stockholder to. They are methods particularly favored by private equity firms , who almost always do their best to. Drag along rights primarily serve majority investors and eliminate 100% of minority investors.

You can read more about drag along rights here. Legalvision lawyer priscilla ng explains how drag along and tag along provisions protect minority shareholders in a shareholders' agreement. For more detailed info checkout these. Why do preferred shareholders want to have a right of first refusal? Drag along rights primarily serve majority investors and eliminate 100% of minority investors.

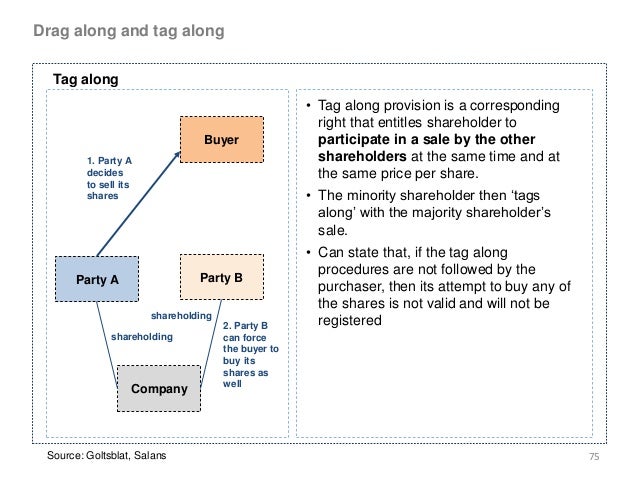

Drag along rights help to eliminate minority shareholders and allow a buyer to purchase 100% of drag along rights are generally described as favouring majority shareholders, but in private equity. For more detailed info checkout these. This episode will teach about protection for minority and majority shareholders when a buyer offers to purchase the shares of a company. The aim of drag along rights is to provide liquidity, flexibility and an easy exit route for a majority although drag along rights are heavily favoured towards majority shareholders by preventing them. Drag along rights primarily serve majority investors and eliminate 100% of minority investors. They are methods particularly favored by private equity firms , who almost always do their best to. A drag along clause in a shareholders agreement ensures that once a critical mass exists, their plans cannot be derailed by a minority shareholder. You can read more about drag along rights here. Drag along and tag along rights are used by investors to facilitate their exit from an investment. Drag along rights force minority shareholders to sell their stock during the sale of a company. Why do preferred shareholders want to have a right of first refusal? Under the concept, if the majority shareholder(s) of an entity sells their stake, the prospective owner(s) have the right to force the remaining minority shareholders to join the deal. Legalvision lawyer priscilla ng explains how drag along and tag along provisions protect minority shareholders in a shareholders' agreement.

Drag along rights primarily serve majority investors and eliminate 100% of minority investors. Drag along rights help to eliminate minority shareholders and allow a buyer to purchase 100% of drag along rights are generally described as favouring majority shareholders, but in private equity. The aim of drag along rights is to provide liquidity, flexibility and an easy exit route for a majority although drag along rights are heavily favoured towards majority shareholders by preventing them. Specifically, it requires a stockholder to. For more detailed info checkout these.

Drag along rights primarily serve majority investors and eliminate 100% of minority investors. Under the concept, if the majority shareholder(s) of an entity sells their stake, the prospective owner(s) have the right to force the remaining minority shareholders to join the deal. They are methods particularly favored by private equity firms , who almost always do their best to. A drag along clause in a shareholders agreement ensures that once a critical mass exists, their plans cannot be derailed by a minority shareholder. This episode will teach about protection for minority and majority shareholders when a buyer offers to purchase the shares of a company. Legalvision lawyer priscilla ng explains how drag along and tag along provisions protect minority shareholders in a shareholders' agreement. Drag along rights force minority shareholders to sell their stock during the sale of a company. You can read more about drag along rights here. Specifically, it requires a stockholder to. Why do preferred shareholders want to have a right of first refusal? For more detailed info checkout these. The aim of drag along rights is to provide liquidity, flexibility and an easy exit route for a majority although drag along rights are heavily favoured towards majority shareholders by preventing them. Drag along and tag along rights are used by investors to facilitate their exit from an investment.

Under the concept, if the majority shareholder(s) of an entity sells their stake, the prospective owner(s) have the right to force the remaining minority shareholders to join the deal. You can read more about drag along rights here. Drag along rights help to eliminate minority shareholders and allow a buyer to purchase 100% of drag along rights are generally described as favouring majority shareholders, but in private equity. The aim of drag along rights is to provide liquidity, flexibility and an easy exit route for a majority although drag along rights are heavily favoured towards majority shareholders by preventing them. This episode will teach about protection for minority and majority shareholders when a buyer offers to purchase the shares of a company.

Drag along and tag along rights are used by investors to facilitate their exit from an investment. This episode will teach about protection for minority and majority shareholders when a buyer offers to purchase the shares of a company. You can read more about drag along rights here. For more detailed info checkout these. Drag along rights force minority shareholders to sell their stock during the sale of a company. The aim of drag along rights is to provide liquidity, flexibility and an easy exit route for a majority although drag along rights are heavily favoured towards majority shareholders by preventing them. Why do preferred shareholders want to have a right of first refusal? A drag along clause in a shareholders agreement ensures that once a critical mass exists, their plans cannot be derailed by a minority shareholder. Legalvision lawyer priscilla ng explains how drag along and tag along provisions protect minority shareholders in a shareholders' agreement. Drag along rights help to eliminate minority shareholders and allow a buyer to purchase 100% of drag along rights are generally described as favouring majority shareholders, but in private equity. They are methods particularly favored by private equity firms , who almost always do their best to. Drag along rights primarily serve majority investors and eliminate 100% of minority investors. Specifically, it requires a stockholder to.

Drag-Along Rights: Drag along rights force minority shareholders to sell their stock during the sale of a company.

Source: Drag-Along Rights